New PKT is here

There is a new PKT project launching on the BASE chain. BASE is a blockchain operated by Coinbase and which uses Optimistic Rollups to interoperate with Ethereum. BASE has low gas fees, and you will pay those fees in normal Ethereum on the BASE chain.

In this new project, the PacketCrypt mining algorithm is gone. In place of mining you will be able to earn yields by staking PKT and operating infrastructure. PKT holders are able to claim an airdrop of the new coins which they can sell, or stake in order to yield more.

This project is, at it’s heart, a technological upgrade of the original PKT project, and in this post I will explain why.

It has been five years since the launch of the PKT project. In those five years we have had some success, and we’ve had some setbacks. It’s a good time right now to take a look at where we are, and where we want to be.

The first and perhaps most important success of this project is that we’re all still here. Everyone who was around from 2019 through 2021 is still here today. To think of the number of projects which came and went over the past 5 years is staggering, so for that alone, we’re in the top of our class.

In the years since the project was launched, the crypto world and the world at large have both changed radically. As is the norm with cutting edge technology, some ideas which were expected to become the global standard did not reach their goals, while others which were considered fatally flawed ended up seeing those flaws resolved and then going on to thrive.

There’s always a certain amount of pride that gets tied up in technological picks, and that pride is necessary because you can’t win if you don’t believe. But when you have numerous different projects all vying for dominance, the chance of backing the wrong horse is incredibly high. When it becomes clear that you’re on the wrong path, you need to be able to put your pride away and pivot.

In 2019 when we launched the PKT project, there were really only two mainstream ways to launch a project. Either you launched a Layer1 Proof-of-Work coin, or you launched an Ethereum token with an ICO.

At this time, Ethereum tokens were often painfully expensive to transact in, and the Ethereum community had no convincing plan for scalability. On the Bitcoin side, Lightning Network was designed from its inception to scale all across the world, and given that it was modeled on the already dominant SWIFT payments system, there was no reason to think that it wouldn’t.

Finally, Bitcoin had a much better story at that time, they were the stoic developers, the “adults in the room” who had never hard forked since 2010 and would sit back and let other projects innovate and then simply copy the winners.

PKT has always prioritized the long haul, and when we launched, there was simply no better alternative than a native Proof-of-Work chain. But times have changed, and developments within the Ethereum ecosystem have accelerated to such an extent that I think it’s highly unlikely that other ecosystems will ever catch up. The biggest game-changers that I’ve identified are Proof-of-Stake, Optimistic Rollups, and Liquidity Pools (DEXes).

Proof-of-Stake

In 2019, it was widely believed that Proof-of-Stake could never work. The reason for this was because mathematical modeling showed that as the rich get richer, they would eventually control over half of all coins and then by extension they’d control the whole project. It was also suggested that Proof-of-Stake projects might fork into multiple different chains, both equally valid and with no way for nodes to tell which is correct. Proof-of-Work uniquely has a “connection to reality”. Anyone can trivially check that the work has been done, and anybody can trivially participate in doing it.

What we have learned since the Ethereum 2 launch is that Proof-of-Stake is not actually as dangerous as we had feared, and Proof-of-Work is not as decentralized as we had imagined. The main risk from Proof-of-Stake, that the rich would get richer until they control the whole project, turned out not to be an issue. Once the initial coins have been issued to the community (by Proof-of-Work in Ethereum’s case), the block reward could be cut down dramatically, as stakers do not require nearly as much resources as miners.

The world famous decentralization of Proof-of-Work has also proven to be not what it seemed. It was believed that Proof-of-Work would correspond roughly to the will of those buying into the project. In reality, it ended up representing the will of those who are able to mine at a loss. Most people are not able to mine at a loss for any extended period of time, but there are some who can. These will include scammers, botnet operators, and other underworld figures who typically have no interest in the project except to mine and sell, but they can also include nation-states, intelligence agencies, and other similar power structures that may have significant interest in controlling, influencing, or undermining a project.

Since Ethereum has switched to Proof-of-Stake, the largest staker has only 24% of all the staked Ethereum. 48.7% are “other” operators too small to count. In contrast, Bitcoin mining has largely centralized around two organizations, AntPool in China, and Foundry USA. Both of these organizations are almost certainly mining at a loss, with support of governments who know that without willingness to lose money mining, they would lose their influence over the Bitcoin chain.

The PacketCrypt bandwidth-hard Proof-of-Work has unfortunately proven even more susceptible to centralization. This is because bandwidth is much less costly when it is between mining equipment that’s all in the same room. This centralization risk was known at the time of PacketCrypt’s creation, but it was thought that Proof-of-Work in general was resistant to centralization and this safety margin of resistance would hold.

What we learned was that all Proof-of-Work tends to centralize around those willing to mine at a loss, Bandwidth-Hard Proof-of-Work just does so faster.

In PacketCrypt’s history, there was once a rather flattering suggestion that it would eventually kill the internet. This was around the time when it was fashionable to claim that Bitcoin mining was destroying the planet. Of course none of these things ever came to pass, but what has occurred is that mined coins have proven less competitive than their non-mined counterparts.

With the timestamping problem solvable by Proof-of-Stake, the only justification for Proof-of-Work is fair issuance of the coin. But even that is now solvable by making a coin which yields new issuance to whoever stakes the liquidity pool.

New projects without Bitcoin’s gravitas are almost universally turning away from Proof-of-Work because even if it doesn’t destroy the internet, or cook the planet, it does still create a massive drain of resources out of a project’s ecosystem. With all of the other options available now, I find it highly unlikely that any new projects will become successful on top of a Proof-of-Work validation architecture.

Optimistic Rollups

When the PKT project first started, creating coins and tokens was very expensive. Either you needed to create your own blockchain, or you needed to build on top of a project like Ethereum with its high fees. Creating one’s own blockchain obviously requires an extraordinary amount of effort, and it’s clear that while Ethereum could serve hundreds or even thousands of projects, it will never satisfy the demand for tokens, especially as we in the PKT project envisioned the rise of a bandwidth marketplace where units of bandwidth would be represented as tokens.

We had an idea for a protocol which we called TokenStrike. TokenStrike would allow the scalability necessary for nearly free tokens, each of which would exist on its own micro-chain and would be exchangeable using the Lightning Network.

Much of the PKT Roadmap was predicated on the expectation that the Lightning Network would blossom to become the global standard in instant settlement and cross-chain transactions, but five years later we are forced to admit that the Lightning Network future simply did not materialize.

What came in place of both Lightning Network and TokenStrike was the Optimistic Rollup. Ethereum is obviously quite costly to transact in as it is a well known chain and it has limited block space. It has always been possible for others to create Ethereum-like blockchains, but these would be disconnected from the main Ethereum chain and so they couldn’t be used to hold the actual ETH asset, until Optimistic Rollups were invented.

The essence of an Optimistic Rollup is that one can place Ethereum into a contract where a certain validator (e.g. a company) is then authorized to decide where and when it should be sent. The validator runs their own blockchain, and when you send ETH to their contract, it credits you with the same ETH on its internal chain which you can withdraw back to main Ethereum at any time.

While the validator has the primary right to initiate transfers from the contract, there’s a safeguard against it stealing people’s coins: The contract allows people to challenge the validator’s decision, requiring the validator to then prove that the coins it’s sending went through a legitimate chain of custody on its blockchain. Because the validator’s chain uses the same smart contract language as the main Ethereum chain, all of the transactions made on the validator’s chain can be understood by the Ethereum chain, in case it needs to show its work.

This simple protocol completely changed the game for Ethereum scalability. While there’s only one Ethereum main chain, there’s no reason why there couldn’t be hundreds, or even thousands of side-chains built on variations of this technology. Not only did Optimistic Rollups get out ahead of what TokenStrike intended to become, Optimistic Rollups even got out ahead of Lightning Network as a whole.

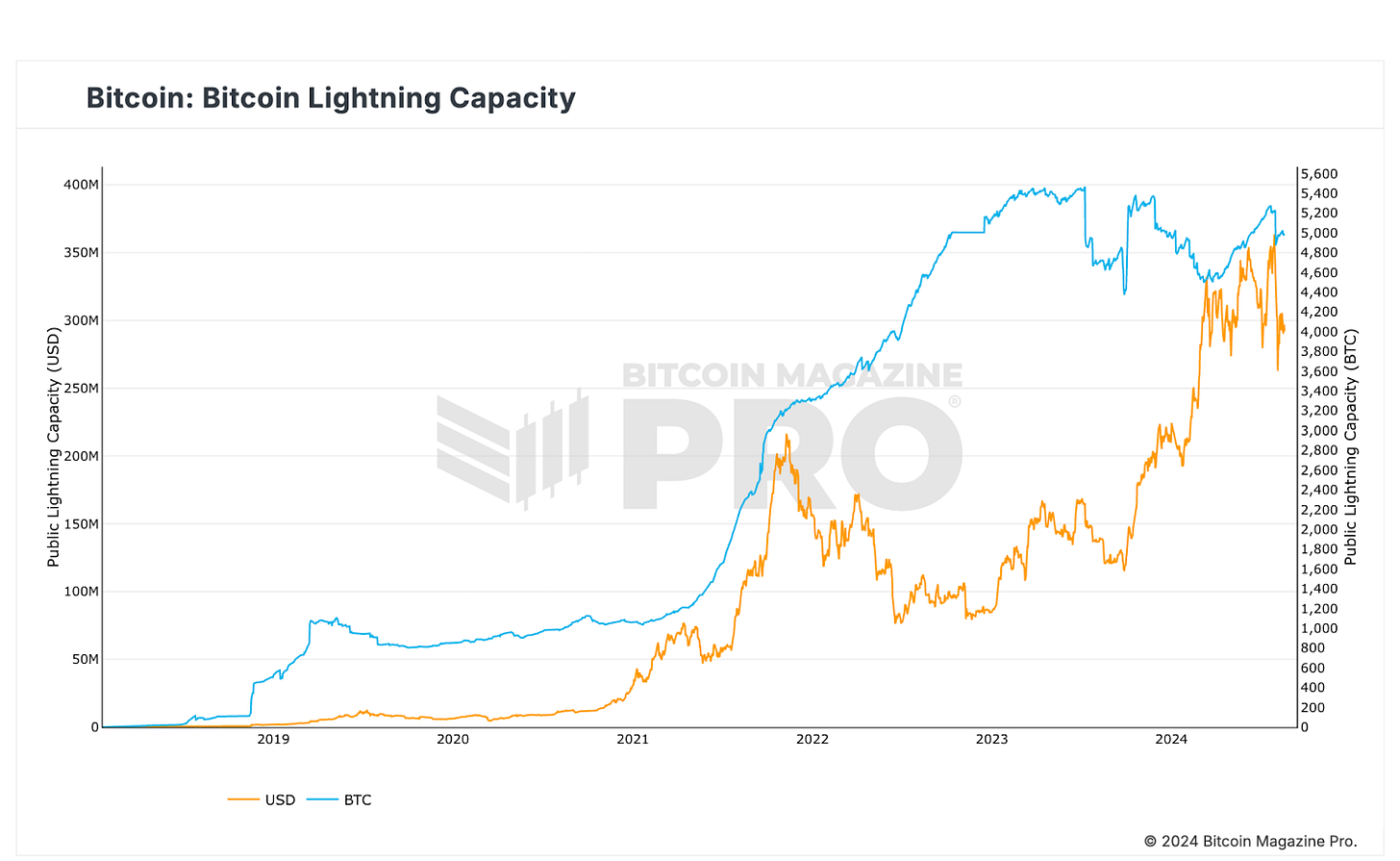

Since the beginning of 2023, Bitcoin Lightning Network has stopped growing in BTC terms. The rising price of Bitcoin has brought it up to $400mn of liquidity, but even that pales in comparison with Uniswap’s gargantuan $3.09bn of total locked value. In the world of protocols, network effect is king, and there’s just no metal for coming in second place.

Liquidity Pools

As of this day, 2021 has been the most successful year the PKT project ever had, and it was also the year that Liquidity Pools, or “DEX”es made their debut. The idea of an LP for those who aren’t familiar, is a smart contract which allows people to place the two assets (e.g. ETH and PKT) in the contract, and then people can use the contract to swap (exchange) between one asset and the other without a counterparty.

Based on this relatively simple concept, Liquidity Pools have emerged offering the ability to transact between all different types of assets without all of the bureaucracy, risks, and costs associated with centralized exchanges. If you want to create a joke token to trade with your friends, no centralized exchange will ever list it, but you can trivially deploy a Liquidity Pool contract. Simplicity, flexibility, and low barrier of entry have driven Liquidity Pools to take the exchange market by storm, with the Uniswap ETH/USDT market holding more liquidity than the largest centralized exchanges.

This democratization of token trading is something we described in TokenStrike and the PKT Whitepaper. We just imagined that they would come through the Lightning Network and cross-chain atomic swaps, and instead it materialized in Ethereum based technologies.

The Way Forward

With low cost smart contract platforms, things we could only dream about are just a few lines of code away. We spent five years laboring on the PKT Lightning Wallet, only to find that we were building on a tech stack that was slowly turning into a ghost town.

In the 1990s, Apple bet a their computer business on the IBM PowerPC microprocessor architecture, and this was actually a good idea at the time. PowerPC was the best thing out there, it was backed by IBM, and there was every reason to think it would become the standard. Intel was a relatively small company, and their x86 based processor was a cobbled mess by comparison. But over the decade, Intel began to chip away at PowerPC’s dominance and as their chips got put into more and more PCs, they became faster and faster until eventually it became clear that the PowerPC was not going to catch up.

In the world of competing standards where network effect is everything, there is no prize for second place. Apple understood this and they made an extremely bold move and pushed their entire ecosystem over from PowerPC to Intel architecture. This was not just a change of processor, but in fact a change of byte order. So all of the code written by Apple and Apple developers had to be checked for issues. This kind of bold action is something you only do when you know the alternative is being stuck with a protocol that will get a little bit smaller, and a little bit further behind every year until it eventually dies. Apple was smart enough to take this bold action, and they have gone on to become a trillion dollar company, while the PowerPC architecture has faded into obscurity.

By moving to the the Ethereum based ecosystem, we will have the ability to implement on-chain domain names, bandwidth leases, and bandwidth trading markets all within the year. These things were so far out of reach before, we struggled to even build a good quality wallet. This was because we were the ones having to build everything ourselves.

This transition not only integrates us into a true thriving ecosystem, but will give us the ability to get back to executing the PKT mission as defined in the whitepaper.